Australia offers excellent education and global career opportunities. In this blog, we’ll walk you through everything about the Chartered Accountant course in Australia from eligibility and course structure to top universities, fees, and how to get qualified.

Let’s get started!

Table Of Content

1What is a Chartered Accountant (CA) in Australia?2Chartered Accountant Course in Australia3CA ANZ Accredited Universities in Australia4Chartered Accountant Course in Australia Requirements5Chartered Accountant Course Fees in Australia6CA Course Duration in Australia7Job Opportunities After Chartered Accountant Course in Australia8Conclusion9Frequently Asked Questions

What is a Chartered Accountant (CA) in Australia?

A Chartered Accountant (CA) in Australia is more than just an accountant; they’re trusted experts in finance, tax, auditing, and business advice. In most countries, the Chartered Accountant course is known as a professional accounting program.

To earn the CA title, you’ll need the right education, pass challenging exams, and gain real-world experience through CA ANZ. It’s a respected qualification that shows your commitment to high professional and ethical standards, both in Australia and globally.

Chartered Accountant Course in Australia

The Chartered Accountant course in Australia, run by Chartered Accountants Australia and New Zealand (CA ANZ), is a respected program that helps you build strong skills in accounting, finance, audit, taxation, and business strategy.

To become a CA, you usually need to finish an accounting degree, join the CA Program, pass the exams, and get hands-on experience through work. CA ANZ also offers short courses and ongoing training so members can stay up to date with new technology, data analytics, AI, and ethical practices in finance.

A Closer Look at the Chartered Accountant Course in Australia:

Course Requirements

Education:You’ll need a bachelor’s degree in accounting, finance, or something similar. If your degree is in a different field, you might just need to take a few extra courses to get started.

Provisional Membership: Before you can start the program, you’ll need to sign up as a provisional member with CA ANZ.

Course Structure

Program: Professional Accounting courses.

Subjects: 9 total – 7 core + 2 electives.

Core Subjects: Include Ethics, Financial Reporting, Audit, Tax, Strategy, and more.

Electives: Options like Advanced Tax, Data Analytics, and Financial Modelling.

Study Mode: Flexible – part-time (common), full-time, or through universities.

Duration: Around 1 year full-time or 2-3 years part-time

Mentored Practical Experience (MPE)

Requirement: 3 years of relevant work under a CA mentor.

Purpose: Combines real world experience with your studies.

Assessment & Completion

You’ll have to complete exams, assignments, and case studies as part of the course. It also helps you learn important skills like doing the right thing (ethics), solving problems, using technology, and communicating clearly. Even after you finish the course, you’ll need to keep learning to stay up to date as a Chartered Accountant.

Career Impact

Recognition: Learn the CA title and full membership.

Opportunities: Work in auditing, tax, finance, and leadership roles globally.

Further Study: Some programs combine CA study with a master’s degree.

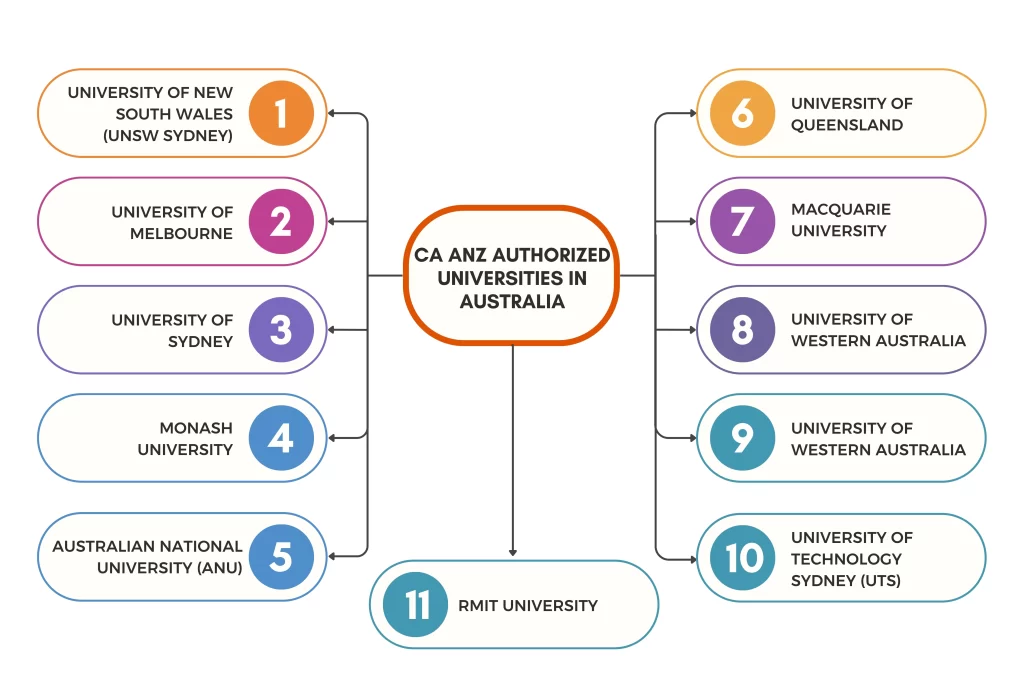

CA ANZ Accredited Universities in Australia

Choosing the right university is a key first step if you’re planning to take the Chartered Accountant course in Australia. CA ANZ approves several universities with degrees that meet the entry requirements for the CA Program. which is why they’re a great choice for future Chartered Accountants.

Here are the top CA ANZ-accredited universities in Australia:

1. University of New South Wales (UNSW Sydney)

2. University of Melbourne

3. University of Sydney

4. Monash University

5. Australian National University (ANU)

6. University of Queensland

7. Macquarie University

8. University of Western Australia

9. University of Adelaide

10. University of Technology Sydney (UTS) and RMIT University

These universities are well-known, and their approved accounting programs make it easier for you to become a Chartered Accountant in Australia.

Chartered Accountant Course in Australia Requirements

If you want to become a Chartered Accountant in Australia, there are a few key steps to follow. CA ANZ sets the requirements to make sure you have the right education, practical experience, and ethical knowledge. As one of the demanding courses in Australia, the CA Program requires commitment and preparation.

In this section, we’ll cover the main requirements of the Chartered Accountant course in Australia to help you understand what it takes to begin and complete the CA Program.

1. Academic Qualifications

You’ll need a CA ANZ-accredited degree or one that’s equal to an Australian or New Zealand bachelor’s degree (AQF Level 7 or above). Your studies should cover key areas like accounting, audit, tax, law, finance, and business.

If your degree isn’t accredited, you can take extra courses or go through an assessment process.

Also, if your degree wasn’t taught in English, you’ll need to prove your English language skills.

2. Provisional Membership

Before joining the CA Program, you’ll need to apply for provisional membership with CA ANZ.

3. CA Program Structure

The program includes Graduate professional Accounting courses with 7 core subjects and 2 electives. Topics include ethics, tax, audit, strategy, and more.

It’s usually done part-time over 2 to 3 years.

4. Career Pathways

If you’re a qualified Chartered Accountant in Australia, you could work in roles like:

- Financial Analyst

- Corporate Accountant

- Tax Advisor

- Auditor

- Management Accountant

- Chief Financial Officer

- Risk Manager

- Investment Banker

- Wealth Manager

- Financial Controller

5. Other Requirements

- Submit a fit and proper person declaration

- If you’re on a temporary visa, make sure it allows you to study

- Stay updated with ongoing professional development after qualification

Chartered Accountant Course Fees in Australia

The fees for the Chartered Accountant course in Australia can vary depending on how you choose to study either directly through the CA ANZ Program or through a university that offers an accredited CA program.

Let’s take a quick look at the fees for the Chartered Accountant course in Australia:

| Category | Details | Approximate Cost (AUD) | Notes |

|---|---|---|---|

| CA Program Tuition (Direct CA ANZ) | Fee per subject (9 subjects total: 7 core + 2 electives) | 1,500 – 1,600 per subject | Total approx. 13,500 – 14,500 for full program |

| Payment Options | Pay upfront or use FEE-HELP loan | N/A | FEE-HELP defers payment, income-contingent repayment applies |

| Additional Fees (CA ANZ) | Study support workshops (optional), exam deferrals, materials replacement | 200 – 500 (varies) | Optional workshops and admin fees |

| Provisional Membership Fee | Annual fee before full qualification | ~499 | Required to enrol and remain in the CA Program |

| Full Membership Fee (Post-qualification) | Annual membership dues after certification | ~899 | Required to maintain CA designation |

| Public Practice Certificate Fee | For those setting up their own accounting practice | 1,300+ | Separate from membership fees |

| University Integrated Master’s Program Fees | Total tuition for Master’s program aligned with CA Program | 35,000 – 86,000+ | Varies widely by university, includes full degree tuition over 1.5-2 years |

| Living Expenses (Annual Estimate) | Accommodation, food, transport, personal expenses | 16,000 – 36,000+ | Depends on city and lifestyle |

| Student Visa Fee (for International Students) | Visa application fee | ~2,000 | Required for international students |

| Textbooks and Materials | Study materials and textbooks per year | 500 – 1,000 | Varies by subjects and courses |

CA Course Duration in Australia

The duration of the Chartered Accountant course in Australia usually includes two main parts: your university degree and the CA Program itself, both structured within the Australian Education System.

Here’s a quick look at how the timeline works:

Professional Accounting Courses

This takes about 1 year full-time or 2+ years part-time. It includes 9 subjects (7 core and 2 electives), with four intakes each year for flexibility.

Mentored Practical Experience (MPE)

You’ll also need 3 years of work experience in an approved accounting or finance role, guided by a qualified CA. You can do this during or after your studies.

In total, becoming a CA usually takes around 3 years or more, depending on your pace. The program is flexible, so you can study and work at the same time.

Job Opportunities After Chartered Accountant Course in Australia

After completing the Chartered Accountant course in Australia, you can explore various job roles with good salaries. To give you an idea of the chartered accountant salary in Australia. Here is a list of common jobs and what they usually pay:

| Job Title | Annual Salary Range (AUD) | Responsibilities |

|---|---|---|

| Financial Analyst | 80,000 – 100,000 | Analyze data, create reports, assist investment decisions |

| Tax Advisor | 70,000 – 90,000 | Tax planning, compliance, advisory for individuals & businesses |

| Auditor | 65,000 – 85,000 | Conduct audits, ensure regulatory compliance |

| Corporate Accountant | 75,000 – 95,000 | Manage internal accounts, reporting, budgeting |

| Management Accountant | 90,000 – 110,000 | Budgeting, forecasting, cost analysis, internal decision support |

| Chief Financial Officer | 85,000 – 105,000+ | Finance strategy, senior leadership |

| Investment Banker | 90,000 – 120,000+ | Investments, M&A, capital raising |

| Risk Manager | 200,000 – 300,000+ | Identify, manage financial risks |

| Wealth Manager | 120,000 – 200,000 | Personalized financial/investment advice |

| Financial Controller | 80,000 – 130,000 | Oversee all financial operations and reporting |

Conclusion

if you’re thinking about studying accounting, going for a Chartered Accountant course in Australia with CA ANZ is a great choice. With the strength of Australia education, you get the chance to study at top universities, build a strong career, and even explore long-term options like staying and working in Australia. We get it, figuring it all out can feel a little overwhelming. But that’s what we’re here for! From helping you pick the right course to guiding you through the application process, we’ll be with you every step of the way.

Excited to begin your CA journey in Australia? Contact us now!