If you’ve ever wondered how to become a CPA in Canada, you’re in the right place. I’ve broken down the entire process into simple, actionable steps so you can plan your journey without confusion. Whether you’re a student, a working professional, or an international accountant, this guide will give you clarity on education, exams, work experience, salary, and job opportunities.

Table Of Content

1What is a CPA in Canada?2CPA in Canada Requirements3How to Become a CPA in Canada4CPA Jobs in Canada5Top CPA Firms in Canada6Chartered Professional Accountant Salary in Canada7Conclusion8Frequently Asked Questions

What is a CPA in Canada?

A CPA (Chartered Professional Accountant) in Canada is the top accounting designation that handles financial reporting, auditing, taxation, and strategic decision-making for businesses and organizations.

The CPA designation combines the roles of Chartered Accountant (CA), Certified Management Accountant (CMA), and Certified General Accountant (CGA) under one umbrella.

Holding a CPA license in Canada not only enhances credibility but also ensures access to in-demand jobs across industries.

CPA in Canada Requirements

Here are the requirements to become a CPA in Canada:

1. Education

Obtain a bachelor’s degree in accounting, finance, or a related field. Make sure you’ve covered prerequisite courses required by CPA Canada.

2. Language Skills

Proficiency in English or French is required (Level 8 recommended for international applicants).

3. CPA Professional Education Program (PEP)

PEP is the official CPA training pathway. It includes six modules—two core, two elective, and two capstone modules. This program blends online learning, workshops, and assignments.

4. Practical Experience (PER)

You can’t skip the experience. CPA Canada requires 30 months of supervised work in accounting, audit, tax, finance, or related roles.

5. Final Exam (CFE)

The Common Final Examination (CFE) is a three-day test that looks at your technical knowledge, problem-solving, and communication.

6. Additional Considerations

Good character and professional ethics are mandatory.

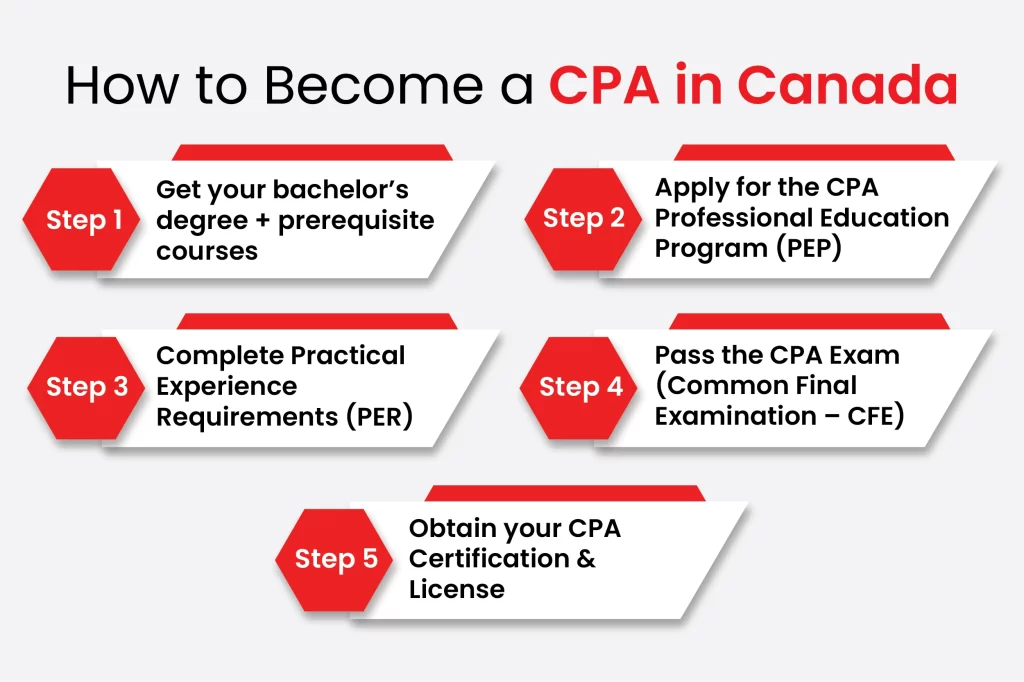

How to Become a CPA in Canada

To become a CPA in Canada. Here’s a clear roadmap:

Step 1: Meet Educational Requirements

First things first—you need a bachelor’s degree from a recognized university, ideally in accounting or a related field.

- Make sure you cover 14 prerequisite courses, including Financial Reporting, Audit, Taxation, and Strategy. Missing any? No worries—you can complete them through CPA preparatory courses.

- If your degree is from outside Canada, you’ll need to submit transcripts for evaluation to confirm Canadian equivalency and ensure you have the required 120 credit hours.

Step 2: Apply for the CPA Professional Education Program (PEP)

Once your education checks out, it’s time to enroll in the CPA PEP. This is a modular program designed to turn theory into real-world accounting skills:

Core Modules – fundamentals of accounting and finance

Elective Modules – specialize in areas like taxation, assurance, or finance

Capstone Modules – case-based learning to prepare you for real-world challenges

Also, you’ll need to declare good character and provide supporting documentation if required.

Step 3: Complete Practical Experience Requirements (PER)

- Next, gain 30 months of supervised work experience in accounting, audit, finance, or related roles.

You can earn this before or during PEP studies. - Real-world experience is key: it’s where you connect theory with practice and prepare for the CFE.

Step 4: Pass the CPA Exam (Common Final Examination – CFE)

The CFE is a 3-day, case-oriented exam designed to test:

- Applied accounting knowledge

- Problem-solving skills

- Professional ethics

You need 75 out of 99 in each module to pass. Yes, it’s challenging—but totally doable with proper preparation. Passing the CFE is your gateway to officially becoming a CPA in Canada.

Step 5: Obtain CPA Certification and License

Once you pass the CFE and meet PER requirements, you’ll receive your chartered professional accountant licence. Congratulations, you’re officially a CPA in Canada!

CPA Jobs in Canada

CPAs are always in demand jobs in Canada. Whether it’s finance, auditing, taxation, or management—there’s no shortage of opportunities.

The top CPA jobs in Canada include:

1. Financial Analyst

2. Tax Consultant

3. Auditor / Audit Manager

4. Management Accountant

5. Controller

6. Finance Manager

7. Risk & Compliance Officer

8. Chief Financial Officer (CFO)

9. Accounting Manager

10. Business Consultant

Jobs for CPAs in Canada are consistently listed under the NOC Code in Canada for in-demand professions, making them a strong option for those considering Canada immigration. Whether you’re a newcomer or a graduate, how to become a CPA in Canada directly links to long-term career stability and opportunities across industries.

CPA Firms in Canada

The top CPA firms in Canada include Deloitte Canada, PwC Canada, KPMG Canada, EY Canada, BDO Canada, Grant Thornton, MNP LLP, and Smythe LLP.

Now, let’s explore each of these in detail:

| Firm | Key Services | Offices / Reach |

|---|---|---|

| Deloitte Canada | Audit, consulting, digital solutions, tax, risk management | Nationwide presence across Canada |

| PwC Canada | Audit, assurance, tax, advisory | 20+ offices across the country |

| KPMG Canada | Audit, tax, advisory | 40+ locations nationwide |

| EY Canada | Assurance, tax, advisory, strategy | Major Canadian cities |

| BDO Canada | Audit, tax, advisory, business consulting | Part of a global network in 162 countries |

| Grant Thornton | Audit, tax, advisory | Strong presence in Canada & Quebec |

| MNP LLP | Audit, consulting, tax, business advisory | Offices across Canada |

| Smythe LLP | Audit, tax, advisory | Regional presence in Canada |

These firms offer excellent job opportunities in Canada with competitive packages and growth potential.

Chartered Professional Accountant Salary in Canada

On average, CPAs earn between CAD 50,000 and CAD 130,000 per year, but this varies by province, city, and level of experience.

| Levels / Experience | Average per hr / Annual Salary (CAD) |

|---|---|

| Entry-Level CPA | 24.36/hr (~50,000/year) |

| Mid-Level CPA | 39.56/hr (~82,000/year) |

| Senior CPA | 66.67/hr (~130,000+/year) |

CPAs working in cities like Toronto, Vancouver, Calgary, and Montreal usually earn more than those in smaller provinces, as these cities have a strong demand for finance and accounting professionals.

Conclusion

Becoming a CPA in Canada requires dedication, but the rewards—career growth, financial security, and global recognition—make it worth the effort. Whether you’re a student in Canada or an international accountant exploring reasons for Canada immigration, this path can transform your future.

Ready to begin your journey? Visit the Official CPA Canada Website for detailed guidance and registration.

But remember, moving countries is not just about jobs — it’s about setting up life in a new land with confidence. And that’s where expert guidance makes all the difference.

If you’re an accountant planning your career move to Canada, the right guidance can save you time and open doors faster. CanApprove’s experts are here to help you navigate visas, PR, and career opportunities.